If you’re like most people, you’ve probably heard about Bitcoin and/or different types of cryptocurrencies by now.

People say all kinds of thing about crypto: it’s going to inevitably crash, it’s the new money, it’s the easiest way to become a millionaire…

And really, who knows what’s going to happen!

I certainly don’t. But because I’ve been dabbling in cryptocurrency for several months now, I thought I’d share my experience (not opinion) with you.

And before we go on, don’t worry: I’m not about to proclaim myself a cryptocurrency expert. There are lots of people doing that, as it’s very easy to be an expert when something is doing well. :)

Actually, since crypto is so hyped-up right now, I debated even writing this post. But since many of you are interested in alternate ways to earn income, I went for it.

I am not currently selling, nor do I have plans to sell anything crypto-related.

I will include some (mutually beneficial) affiliate links which you can use or not use, but I’m really not invested in what you decide to do.

If nothing else, I figured this would be a good post to hand off to my friends who are interested in cryptocurrency.

This is not meant to be an “be-all, end-all” post. My intention is to share my experiences with you, give you my honest feedback, and then let you know how you can get started if you choose.

That said, let’s dig in…

Initial Results

Back in April or May of 2017, Don held a mastermind at our house. One of the attendees was James Renouf, who was raving about cryptocurrency and all of its potential.

Fueled by James’ enthusiasm and some of his answers to my questions, I decided to invest in Bitcoin.

I signed up for Coinbase which is the easiest way to get started, but they limit the amount you’re allowed to invest in the beginning.

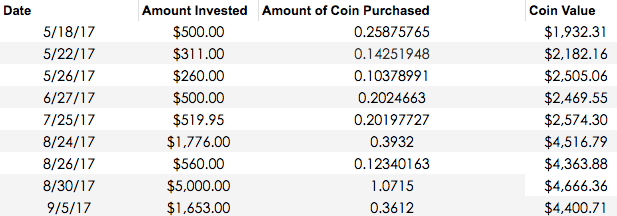

I put in $500 back when Bitcoin was worth $1,932/coin.

Actually, I kept pretty detailed spreadsheets. You can see the investment amounts I put in, coin values when I purchased, and how much Bitcoin was worth via this screenshot of one of my spreadsheets:

With Bitcoin alone, which my friend affectionately calls “Grandma Coin” for its slow ROI, I’ve more than tripled my $11,079.95 investment. The coin has gone up quite a bit since those investments.

There are many other coins – main ones and lesser-known ones called “altcoins” – that yield significantly higher returns.

More results over time…

As I’ve continued to invest in Bitcoin and other coins, I’ve continued to see great results. I made some silly mistakes in the beginning (like “day-trading,” which is when you try to time the market and buy when coin prices are low and sell when you think they’re high – don’t do that!), but I’m still up well over $50,000.

Had I not wasted time day-trading, I would’ve had a LOT more profit to report. I’m not complaining, though.

On September 9, 2017, I invested $250 for my mom. Between Bitcoin and a couple altcoins, she’s earned a 792% return on investment (at the moment, crypto is volatile and goes up and down. This is the lowest I’ve seen in a while, but I know it will go back up over time).

Two or three months later, my sister asked me to invest $500 for her. I was slightly worried that Bitcoin seemed very expensive at the time – around $7k – but I told her that we might see a dip that would even out over time and that I’d try out some altcoins for her. We actually kept most of that $500 in Bitcoin, as I was too busy at the warehouse to do much, and her investment has over doubled.

Do I recommend getting started?

A lot of people say that cryptocurrency is in a bubble and it won’t last forever. Others say the government won’t let it last forever, while others say the whole thing is a fad.

That may all be true… AND the way I look at it is that even if we are in a bubble, and even if it’s only short-term…. there’s a lot of opportunity.

I would definitely recommend that you invest something. If you can not go out for a few meals/movies/other luxuries for the short term and put in even just $100, I believe it’s worth trying.

Even if we are in a short-term spike, you can always take out your principal and let the rest ride.

Here’s the thing. There is not ANY crypto investment I’ve made – even in testing out lots of alt-coins – that hasn’t at least doubled since I put my money in.

Sometimes it took waiting a little bit (as in, 1-2 months), but it always went up.

Now, I’ll be totally transparent. I don’t understand blockchain or cryptocurrency all that well. It’s a lot of tech-speak to me, which generally makes my eyes glaze over. I got started without asking a lot of questions (my general approach) and reaped some great rewards.

Because I don’t understand it enough, I wouldn’t tell you to put your life savings or any amount of money that you can’t afford to lose into it. But I would absolutely, unequivocally, recommend putting in something.

This isn’t a substitute for running a business, doing LHS methods, and it isn’t meant to be a “get rich quick” scheme. My thinking is that if the predictions are right, and cryptocurrency really is going to the moon in the future… you’ll be very happy you got in.

And otherwise, well, you put in what you could afford to lose.

How you can get started

(IMPORTANT – do this now, even if you’re only mildly interested)

If you’re even remotely interested – even a “2” out of “10” on interest – I recommend signing up for as many (safe) exchanges now as you possibly can.

I say this for two reasons:

1) Crypto is gaining a lot of popularity. Exchanges often shut down for days at a time to accommodate all the new signups and there isn’t usually an ETA listed on when they’ll open back up. When this happens, you don’t have the option to invest at all.

Even right now, I’m seeing this message on one of the more popular sites:

2) Some places, like Coinbase, limit the amount of money you can spend according to how long you’ve been a member. Sign up now just so you have the OPTION of spending more if you wanted to.

That said, here’s how to get moving.

Step 1: Deposit USD

The first thing you want to do is sign up for an exchange that allows you to deposit USD.

You’ll find many exchanges, but very few of them accept USD.

The first thing you’ll want to do is sign up for Coinbase. This is where most people get started. The fees are higher, but it’s very user-friendly and easy to get started with.

If you use my affiliate link to sign up and then invest $100, we’ll both get $10 BTC.

Another place you can deposit USD is Kraken. I had a crazy-hard time getting verified with them and I find their interface very hard to use, but you might want to sign up as a secondary option since Coinbase limits your spending.

With either place, you’ll need to verify your ID and sign up with your bank account. This takes a day, two days, or longer.

Step 2: Buy a coin.

There are a few coin options that you can buy from Coinbase. Most people start with buying Bitcoin, but each coin has its benefits. It really depends on your strategy. If you have no strategy, I’d start with Bitcoin, as it’s easy to exchange into other alt-coins.

Here’s how to buy from a browser, copied from Coinbase:

- Go to the Buys page.

- Select the type of digital currency you’d like to buy.

- Enter the amount you’d like to buy denominated in either digital currency or your local currency.

- Select the wallet you wish to have your funds deposited into.

- Select your desired payment method.

- Confirm the order is correct and click Buy.

From there, you can either hold on to your coins as they appreciate in value, exchange them for alt-coins, or do a combination of both.

Step 3a: IMPORTANT – Exchange them for alt-coins (optional)

I’m giving this the “IMPORTANT” tag because, again, a lot of these places close down frequently with the surge in popularity, so I recommend that you sign up for each site now and start the verification process.

There are multiple exchanges that list multiple types of coins. Unfortunately there are no exchanges that have every good alt coin so you’ll need to sign up for multiple places.

The way it works is that each place you sign up with (list below) will give you an “address” that looks like this:

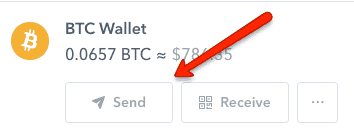

You’d go into Coinbase – Accounts – BTC Wallet, click “Send,” and send a certain amount of Bitcoin to the address you were given.

(By the way, you’ll notice I don’t currently have much BTC inside Coinbase. I’ll explain where mine is as we go along.)

After you send the Bitcoin, it takes a little bit of time to deposit into the exchange. Once it’s received, you can start trading it for other coins that may have a higher ROI.

Here are some of my favorite exchanges that host some of the most profitable alt-coins (sign up for them now if they’re open!):

Cryptopia – Cryptopia has a lot of good alt coins, including one of my favorites: ETN.

Binance – Binance is one of my most-used exchanges. It has a wide variety of coins and many really good ones.

KuCoin – This one offers many alt coin options.

Changelly – I haven’t used this one myself, but multiple people refer to it.

Bittrex – This is one of the places I got started with. I haven’t made a lot of trades on it lately, but it does have some good options.

Poloniex – This exchange has some good alt coins, but it’s also an excellent source for passive income. As you scroll on, you’ll see why.

In terms of finding alt coins to invest in, that goes beyond the scope of this post, but I’ll link you to some of my favorite free places to do research:

Electroneum ETN – This is Pierre Werner’s group where they discuss multiple types of coins.

Crypto Mastery – This is another good group where Itamar Blumenfeld shares some great picks.

And if you don’t find any alt coins you want in either of these exchanges, you can also look at the Coin Market Cap to see what’s available. Just go into one of the alt coins and then “Markets” where it’ll tell you where you can purchase that particular coin.

Step 3b: If you hold them

Poloniex passive income

MyEtherWallet

Poloniex Passive Income Strategy

As previously mentioned, Poloniex.com is a trusted crypto-to-crytpo exchange that I’ve used to generate passive income.

Low-hanging, passive income is really big right now. And using the strategy outlined below, I’ve made $20 or so in a very short amount of time. I realize $20 is hardly a lot of money, but it is passive income, and earning it required little effort on my part.

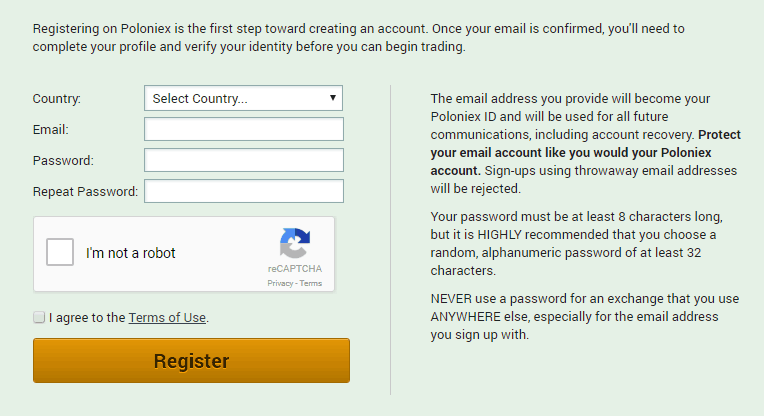

Here’s how to get started with Poloniex.com…

Click the “Create Your Account” button on the homepage. Fill in your information and hit “Register.”

NOTE: Depending on when you sign up, you may encounter the following message:

After registering, you’ll need to check your email for a confirmation letter. Click the link and sign in.

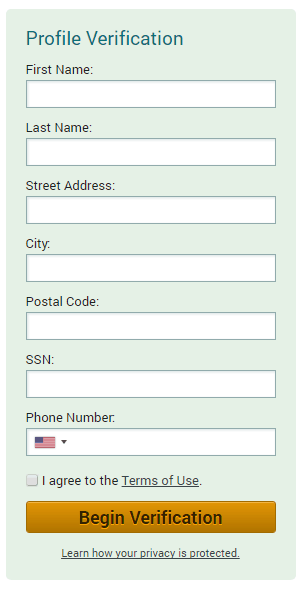

You’ll then need to submit your profile for verification before you can begin trading.

After, you need to start the ID verification process in order to protect yourself from identity theft. You can use a passport, driver’s license, or ID card. You’ll need to use your webcam to take a photo of your ID as well as a photo of yourself.

You should then see the following message:

I’m not exactly sure how long it took for my account to get approved. But when I checked back the following day, I was good to go.

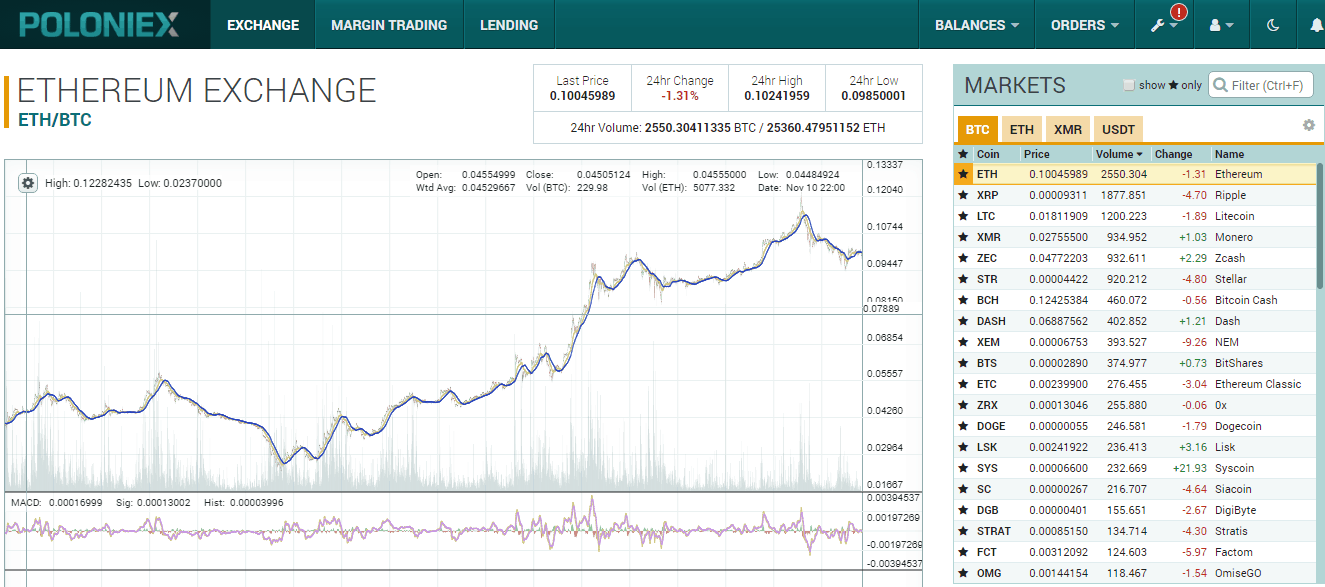

After logging in, this was the first screen I saw (just so you can get an idea).

How Poloniex Works

Poloniex is divided into three tabs:

1. EXCHANGE

This is where you can purchase and sell any coins Poloniex supports.

MARGIN TRADING

You can also buy and sell coins here, but the difference is you use either a loan coins offer or a borrow coins offer from anyone who’s lending their coins in the lending tab.

3. LENDING

This is where you can lend out the coins you’ve purchased from an exchange and earn extra money by adding interest.

Before you can begin lending, however, you first need to purchase some Bitcoin from one of the exchanges mentioned above. You don’t need to purchase a ton of coins — whatever you’re comfortable with — but the minimum amount of BTC you can lend is 0.01.

Once you have some Bitcoin, you need to deposit those funds into Poloniex.

Here’s how to do that…

On your Poloniex account, go to “Balances” and select “Deposits & Withdrawals” from the drop-down.

Look for the Bitcoin name or abbreviation, BTC.

On the far right-hand side, under “Actions,” you’ll see two options: “Deposit” and “Withdraw.”

If you click the “Deposit” link, you’ll get a Bitcoin deposit address. (It’ll be a long series of letters and numbers.)

You then copy that address and go to your wallet in order to make a Bitcoin transfer to the Poloniex exchange.

It’s pretty simple.

Next, after depositing your coins into your account, click “Balance” then “Transfer Balance” so you can move your coins from EXCHANGE to LENDING.

Once the transfer is complete, choose an interest rate — usually 0.03% – 2.00% — and create a “Loan Offer.” Poloniex lets you auto-renew your loan offers so you don’t have to watch them every day.

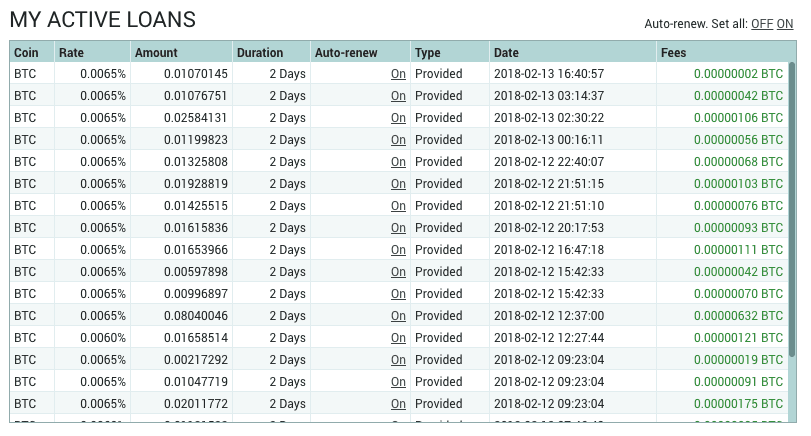

Below, you can see a screenshot of my active Poloniex loans.

And that’s basically it! You’ll then start generating passive income!

Of course, if the BTC value drops, then your earnings will become less or stop altogether (nothing is guaranteed). But if you purchase just a small amount of Bitcoin, it’s pretty much the same as investing in any other type of business. Plus, since the value of cryptocurrency is on the rise again, the timing is great to give this strategy a try (just be mindful that the value may drop again).

Always do your own due diligence.

Best Practices

Here are a few best-practice tips to help you get the most out of your crytocurrency endeavors.

FUD vs. HODL

There’s a lot of market skepticism when it comes to crytocurrency. If you watch the news about it, you’ll undoubtedly hear multiple scare tactics and people spreading fear, uncertainty, and doubt (aka FUD).

Skepticism is kind of par for the course when it comes to innovations and new ideas, though. And so, if there’s a Bitcoin that you really believe in, hold onto it for dear life — or HODL.

As with any kind of investment, you may see Bitcoins drop, but as I was saying to my sister earlier, the value will likely rise with time.

Alt coins are a slightly different story, however. If you’re going to invest in alt coins, I’d suggest doing your research beforehand because there are some types of alt coins that you may not want to HODL.

Investing what you can afford

Additionally, regardless of how you get involved with cryptocurrency (if you choose to do so at all), try not to let it consume too much of your time and energy.

When I first got involved, I was using an app called Blockfolio to track all of my holdings. But I was spending WAY too much time on crypto. Basically, you don’t want this to take over your life, and you definitely don’t want to quit your day job, so to speak. And you should never invest more than you can afford to lose.

Tax implications

Taxes are complicated, but if you’re going to invest in Bitcoin or any other form of cryptocurrency, you need to learn about the tax implications.

Basically, if you hold cryptocurrency as a capital asset, it’s going to be taxed as your property, meaning that capital gains rules apply (similar to buying and selling stock). Here’s what Intuit Turbotax has to say:

“If the Bitcoins are held as a capital asset, like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. Otherwise, the investor realizes ordinary gain or loss on an exchange.”

Another thing you should know is that you may have to pay taxes even if you don’t cash out your cryptocurrency. Kelly Phillips Erb says to think of it this way:

“If you trade in your Amazon shares for Microsoft shares, that’s a taxable transaction, even if you don’t take cash out of your brokerage account. Same analysis.”

If you’d like some help calculating your Bitcoin-related taxes, check out Bitcoin.tax. With this website, you’re able to import the details of any transactions you’ve made involving Bitcoins or alt coins and the site will come up with a tax position for you.

You’ll get to see a Capital Gains Report, an Income Report, a Donation Report, and a Closing Report, detailing your net profit and loss and cost basis.

Protecting yourself and your assets

It’s important to proceed with caution because there are hackers out there who WILL steal your stuff if you’re not careful.

First, you should NEVER give out your account information to anyone. Period. Hopefully that goes without saying. And second, I’d recommend purchasing a hardware wallet (one that’s unused) or MyEtherWallet for account security.

2 thoughts on “Cryptocurrency – Here’s what I’ve learned, earned, and how you can make passive income with it”

I just got a mining rig for a utility coin for a new exchange to come out in the near future. I’m already happy with the returns. Crypto is exciting!

(For some reason, my keyboard is doing all caps here, but not on email or FB. Caps LOCK IS OFF. Odd. Apologies to all!)

Great article Rachel. If you want anyone, it’s my purpose to help folks get acquainted n invest in cryptocurrency. Feel free to get ahold of me if interested, I’d be happy to help